Region mulling over 5 per cent tax increase in 2026 budget

Posted Oct 17, 2025 07:17:39 AM.

Last Updated Oct 17, 2025 10:59:33 AM.

Budget talks are back in the spotlight for regional councillors who are set to begin looking into what’s on the way for 2026.

Those conversations are still in the early stages, but right now, early plans are showing that the region could be eyeing a tax increase of around 5 per cent.

Originally, that 5 per cent mark was set as a cap, with councillors directing regional staff to develop those early budget plans with that threshold in mind.

However, it’s looking like that cap may be what residents across Waterloo Region could expect to see, currently pegged at a 4.94 per cent increase.

“Council directed staff to ‘prepare and present a draft 2026 budget for direct regional services that limits the overall tax levy increase to no more than 5 percent, while maintaining vital services and seeking efficiencies wherever possible,'” regional staff said in its original budget presentation.

That increase would equate to around a $96 increase on the average homeowner’s tax bill next year, but does not include the now projected $57 increase from the expected police budget, which is currently looking to increase by around $20 million.

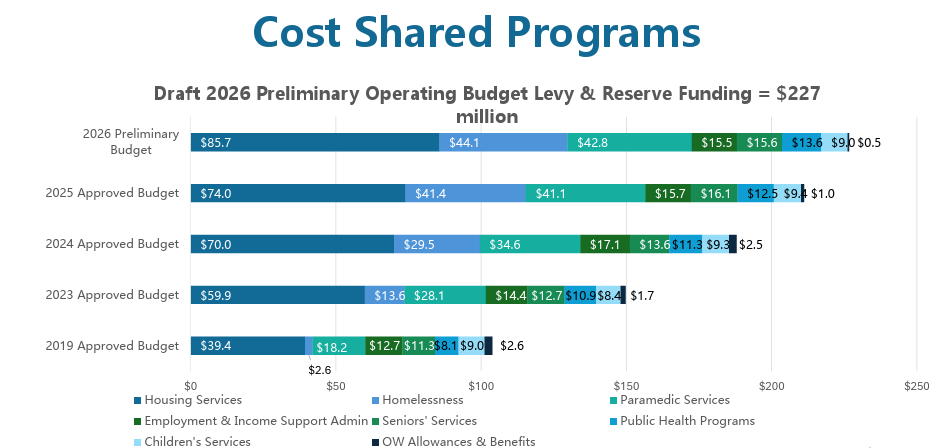

When looking through the numbers for the regional plans, there are a few key areas expected to see some gains across the region. The combined preliminary operating budget levy and reserve funding, including housing services and homelessness, might increase.

Housing services are currently expected to increase by $11.7 million, with homelessness seeing a $2.7 million increase.

On the other hand, there are some notable decreases in other aspects of those figures, with children’s services, employment and income support administration, and seniors’ services all expected to see drops in allocated funding.

Seniors’ services are currently expected to see a decrease of $500,000.

“Every year, Regional Council makes difficult decisions about what we can afford with limited resources,” said the region in a statement on its website. “We know that people in Waterloo Region are dealing with rising costs that make life harder. The 2026 Plan and Budget will need to balance community needs with affordability.”

The expected 4.94 per cent increase would be the lowest seen in the region since 2022, when it increased by 4.84 per cent, and currently sits right in the middle when it comes to increases over the past six years.

The largest increase during that time was last year, heading into 2025, where the region saw a tax increase of 9.89 per cent. The lowest was in 2021, when the region held tax levels, not increasing the impact on residents across the region.

Key dates to keep in mind:

- Wednesday, Oct. 22 – Regional council discussing preliminary budget plans

- Tuesday, Nov. 18 – First day of operating and capital budget review & public information meeting

- Wednesday, Nov. 19 – GRCA presentation & Second day of operating and capital budget review

- Wednesday, Nov. 26 – WRPS budget presentation to regional council

- Wednesday, Dec. 3 – Responses to councillor requests from operating and capital budget review

“Regional Council and staff are working hard to review the budget and ensure we are investing your tax dollars responsibly and efficiently to deliver the services our community needs. We look at which essential priorities we must maintain and which projects can wait for another year.”

The official finalized 2026 budget for the Region of Waterloo is expected to be made in around two months on Tuesday, Dec. 16.

The full list of details on the preliminary budget plans can be found through the Region of Waterloo’s Plan and Budget presentation or on the region’s website.