Region sees decrease in house sales as realtors gear up for policy changes

Posted Oct 4, 2024 09:45:45 AM.

Last Updated Oct 4, 2024 09:45:52 AM.

Cornerstone Association of Realtors put out some statistics that show a slight decrease in house sales last month compared to September 2023, it shows 521 homes were sold in the region, a 2.1 per cent decrease from last year.

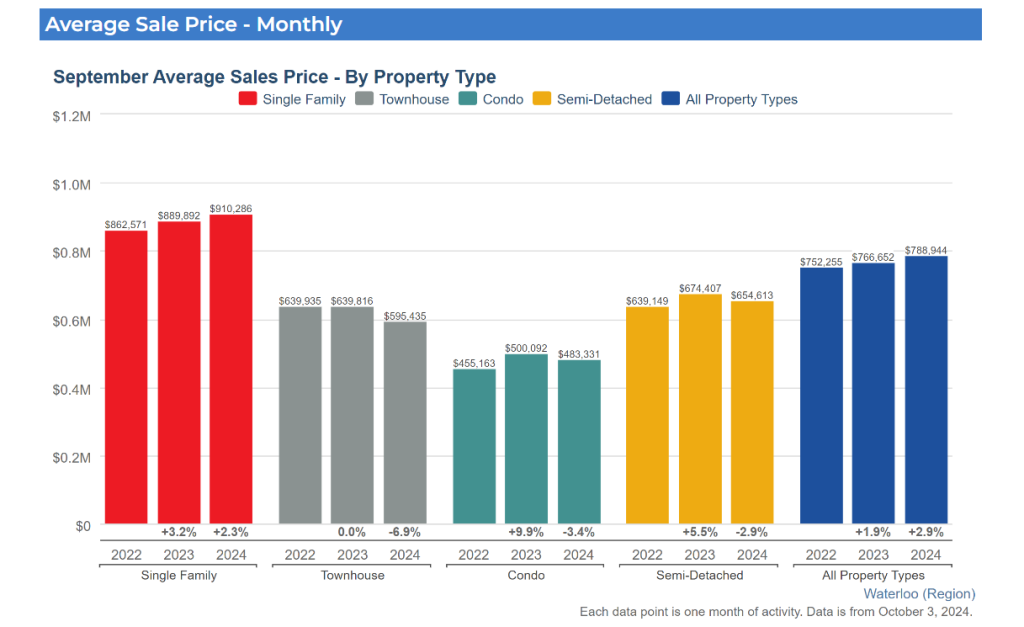

In addition, the average sale price for all residential properties in Waterloo Region was $788,944, representing a 2.9 per cent increase compared to last year and a 2.3 per cent increase compared to August 2024.

Local realtor, Tony Johal, said they saw similar sales this September compared to last, and they’re seeing most of the change come from the townhouse category. Stats show that the average price of a townhouse decreased by 6.9 per cent from September 2023 and the number of people buying one was down by 22.1 per cent.

Johal mentioned he thinks the decrease is to do with move inventory being added, giving buyers more options.

Average housing prices in Waterloo Region

“Now that were into the fall market, for the month of October, probably most of November we’re going to see steady traffic and if the rates do decrease, which is the word on the street, then if that happens to take place we’re going to see probably another spike in the market,” he said.

About 1,313 listings were added to the MLS® System in Waterloo Region in September, a decrease of 6.5 per cent.

The stats show that more people were interested in purchasing a detached home last month, while less people went shopping for a townhouse, condo unit or semi-detached home.

Johal added they are also seeing a spike in more first-time home buyers, with more people shopping in the $500,000-600,000 range.

“Whether that’s because the pricing has come down and it’s become a bit more affordable. Whether that’s because the rates have come down over the last maybe 12 months and it’s starting to get a bit more realistic and they are starting to qualify for more or perhaps it’s just because the rental market is just so competitive,” said Johal.

He also said they are seeing more condominium owners transition into purchasing a house of some kind. But at the same time are noticing an intense rental market where renters know what to look for.

“The listings do have to be priced accordingly because a lot of tenants are very, very familiar with where the rental prices are. They know when something is dramatically overpriced, and they do have the luxury of choice.”

Johal said they are finding a lot of people are looking for homes that are already finished.

“I think where the pricing, is a lot of people are just thinking to themselves, look if I’m paying six or $700, 000 dollars for a house, which is beyond what I expected to pay for my first home. I would at least like for it to be done up and renovated.”

Johal is expecting the market to pick up in the spring following policy changes, the federal government plans to extend mortgage terms to 30 years for first-time home buyers and all buyers of new builds. As well as plans to raise the Canada Mortgage and Housing Corporation insurance cap to $1.5 million.

The changes are set to roll out Dec. 15.

The full scope of the housing report can be found here.